Bujo Finance: Step-by-Step Advice for Saving and Planning

If you’ve been searching for a creative, flexible way to manage your family’s finances, it’s time to get acquainted with bujo finance. Short for “bullet journal finance,” this method combines the customizable power of bullet journaling with smart money management. Whether you’re new to budgeting or a seasoned planner, bujo finance can help you stay on track, reduce money stress, and even make budgeting… fun!

Let’s walk through exactly how to get started, what tools you’ll need, and how to tailor this system to your family’s financial goals.

What Is Bujo Finance?

Bujo finance blends the structure of traditional financial planning with the creative, personalized approach of bullet journaling. Rather than relying solely on spreadsheets or apps, you track income, spending, and goals manually—in a way that makes sense to you.

This system is especially effective for families because it allows everyone to visualize the plan. When budgeting becomes a shared, visible process, it’s easier to stay motivated and work as a team.

Why Bujo Finance Works for Families

Families often deal with variable expenses, shared goals, and household needs that don’t always fit into cookie-cutter budgeting apps. Bujo finance offers the flexibility to:

- Set family savings goals (like a vacation or emergency fund)

- Track irregular expenses (school supplies, sports gear, etc.)

- Map out monthly themes, habits, or challenges (e.g., no-spend weeks)

- Involve kids or teens in understanding budgeting basics

If you’re also considering budget friendly house plans or major purchases, bujo finance can help you lay out all the numbers visually, making big financial decisions feel more manageable.

Step-by-Step: How to Start Bujo Finance

Step 1: Choose the Right Journal

Pick a journal that you’ll actually enjoy using. Most people prefer dotted notebooks because they offer structure without limits. Look for a size that fits your lifestyle—something small enough to carry, but big enough to write comfortably.

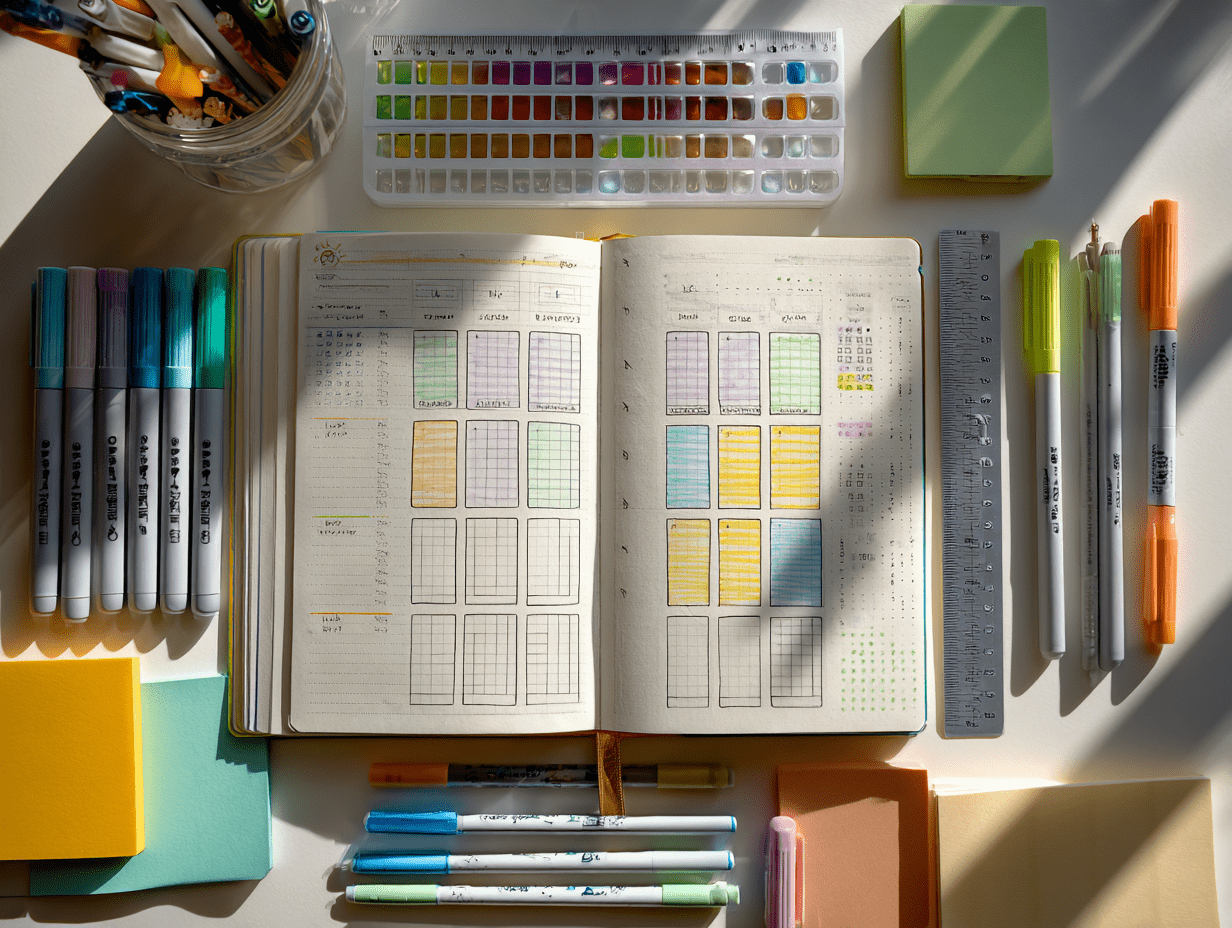

Optional but helpful supplies include:

- Colored pens for category coding

- Washi tape or stickers for aesthetics

- A ruler for cleaner lines

Step 2: Set Up Your Monthly Financial Spread

Each month, set up the following pages in your bullet journal:

- Monthly Budget Overview – List expected income, fixed expenses (like rent, utilities), and variable expenses.

- Spending Log – A daily or weekly tracker to record purchases.

- Savings Tracker – Visualize progress toward goals like emergency savings or a holiday fund.

- Debt Repayment Plan – If applicable, list outstanding balances and track payments.

These don’t need to be fancy—just functional. That said, many people find adding color and design helps make the habit stick.

Step 3: Use a Budget Worksheet Printable (Free Options Available)

To save time or get inspired, try incorporating a budget worksheet printable free from reliable financial blogs or educational websites. These can be glued into your bujo for a hybrid approach.

Printables work well for:

- Grocery lists and meal plans

- Weekly or biweekly spending logs

- Savings charts for specific goals like a down payment or college fund

This mix-and-match approach helps you stay consistent, especially during busy family seasons.

Step 4: Customize Your Bujo for Real Life

This is where bujo finance truly shines. You can tailor your layout to fit your family’s unique needs. For example:

- Add a meal planner to control grocery spending

- Create a sinking fund tracker for holidays, birthdays, or seasonal expenses

- Make a subscription audit page to trim unused services

- Include a “wishlist” section where each family member writes one thing they want—then build those into your budget over time

If you’re planning a budget laundry room makeover or another home improvement, use your bujo to sketch a cost estimate and timeline.

Advanced Bujo Finance Techniques for Long-Term Planning

Once you’re comfortable with basic tracking, your bullet journal can also become a powerful tool for long-term financial planning. You might:

- Set yearly savings goals and break them down by month

- Track recurring annual expenses like insurance, holidays, and memberships

- Monitor your net worth over time with simple graphs

- Add goal-setting spreads for things like paying off debt or saving for a dream vacation

You can even dedicate pages to brainstorming ideas for side hustles, passive income, or investment education. Bujo finance isn’t just for daily budgeting—it’s a full-picture planning tool.

Tips to Stay Consistent With Your Bujo Finance System

Like any habit, consistency is key. Here are a few practical tips to keep your bujo budget going strong:

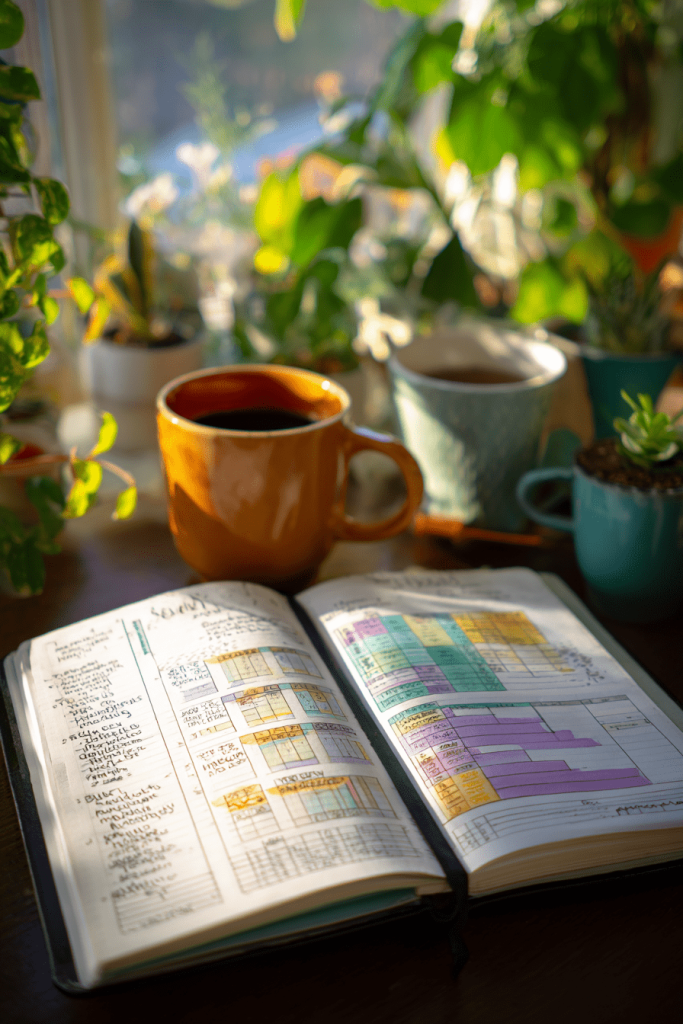

- Pick a review day. Set a weekly family finance check-in—Sunday evenings work well for many.

- Make it fun. Use stickers, stamps, or themed pages to keep things visually interesting.

- Track your wins. Did you stick to your budget this month? Finish a savings goal? Write it down and celebrate!

And remember: your bullet journal isn’t set in stone. If something’s not working, change it next month. The beauty of this system is its adaptability.

Getting Kids Involved in Bujo Finance

Budgeting doesn’t have to be boring for kids! In fact, many families use bullet journals to teach financial literacy early.

Here are a few age-appropriate ideas:

- Young kids can color in savings trackers

- Tweens might log allowance and spending

- Teens can set up their own basic bujo finance spreads with your guidance

These pages can spark conversations about money, priorities, and saving versus spending. When kids see budgeting as part of normal life, they’re more likely to grow into financially responsible adults.

Want to teach kids about money? Check out our post on Finance Affirmations for Saving and Planning.

Digital vs. Analog: Why Bullet Journaling Still Works

Bujo finance stands out from apps by making money tracking a mindful, hands-on process.

In a world full of budgeting apps and digital tools, it’s worth asking: why go analog?

The answer is simple—writing things down helps you slow down and engage with your finances on a deeper level. When you manually write each expense, you build awareness and mindfulness around your spending.

That said, bujo finance doesn’t have to be 100% paper-based. Many families use a hybrid method: bullet journaling for goal setting and tracking, paired with apps or spreadsheets for calculations and automation.

It’s all about what helps you stay consistent and connected to your money.

Final Thoughts: Build a Budget That Works for Your Family

Bujo finance isn’t about making your journal look perfect—it’s about creating a money system that works for you. With just a notebook and a few minutes each week, you can bring clarity to your finances, build better habits, and achieve your family’s goals together.

Whether you’re tracking monthly bills, planning a budget laundry room makeover, or saving for a future home with budget friendly house plans, this method makes money planning tangible and stress-free.

You don’t need fancy tools or expensive planners to get started. Your bullet journal can grow and evolve with your life—whether you’re budgeting for a growing family, adjusting to new income streams, or simply trying to stretch your dollar a little further.

Plus, it’s something you can truly make your own. Your colors, your symbols, your style. The more personalized it is, the more likely you’ll keep up with it—and enjoy the process.

So grab your journal, start sketching out your first spread, and take that first step toward financial peace of mind—one page at a time.

📝 Pro Tip: Save time by downloading a budget worksheet printable free to supplement your pages. The mix of digital and analog tools helps even the busiest families stay organized.