Finance Cheat Sheet: Step-by-Step Advice for Saving and Planning

This finance cheat sheet helps families simplify money management and budgeting. From rent and groceries to kids’ activities and future savings, it’s easy to feel overwhelmed. This finance cheat sheet is here to make budgeting and financial planning much simpler, step by step.

Whether you’re starting from scratch or just want a more organized approach, this guide gives you the tools and confidence to create a family budget, reduce debt, and build savings that stick.

Step 1: Define Your Family’s Financial Goals

Short-Term vs. Long-Term Goals

Start by identifying what matters most to your family financially. This gives your money a purpose. Sit down with your partner or loved ones and define both short- and long-term goals.

Short-term goals may include:

- Saving $1,000 for an emergency fund

- Paying off a small credit card

- Planning a weekend trip

Long-term goals could be:

- Saving for your children’s college

- Buying a home

- Preparing for retirement

Write Them Down

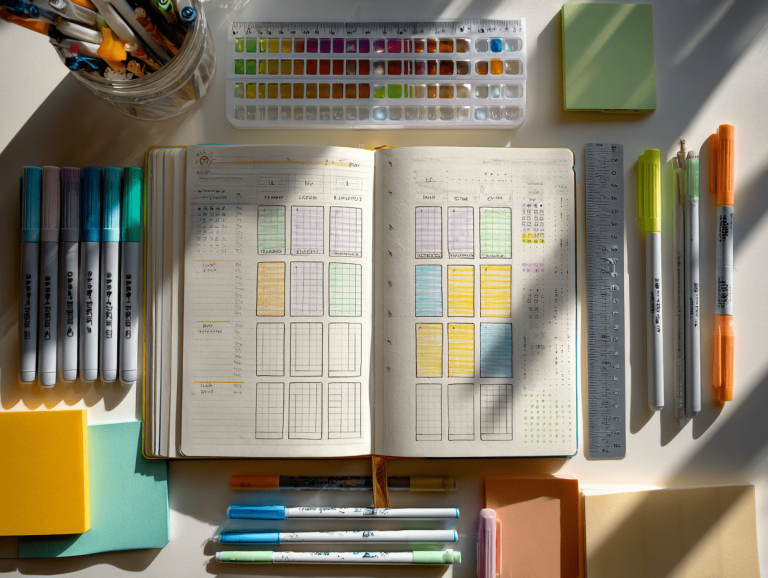

Documenting your goals keeps you focused. Use a paper worksheet or a GoodNotes finance template free for a digital approach. Templates help you revisit goals monthly and track your progress clearly.

Think Beyond the Obvious

Financial goals aren’t limited to big-ticket items. Sometimes, a goal can be emotional—like reducing money-related stress or becoming more organized with bills. Add those types of goals to your list too. You can even turn them into habits, such as committing to weekly financial reviews or meal planning to cut grocery costs.

And don’t forget about teaching financial literacy to your kids. If you have older children, involve them in simple savings challenges or show them how to track spending using a basic finance tracker template. It’s a great way to make money conversations part of family life.

Step 2: Build a Realistic Finance Budget

Track All Income and Expenses

Creating a family finance budget starts with awareness. Record every dollar that comes in—wages, side hustles, tax credits—and where it goes. Track fixed costs like rent or car payments and variable expenses like groceries or kids’ school supplies.

Use a Tracker to Stay Consistent

A finance tracker template or budgeting app can help automate the process. Use printable worksheets if you prefer offline tracking. Tools that categorize your spending automatically make it easier to spot trends and reduce overspending.

Budgeting Tips:

- Set realistic spending limits

- Plan for irregular expenses (birthdays, school fees)

- Revisit your budget weekly to stay on track

Step 3: Start and Grow Your Emergency Fund

Why It Matters

An emergency fund acts like a financial cushion, protecting your family from unexpected events—like medical bills or car repairs—without needing to rely on credit.

How to Build It

Begin with a goal of $500 to $1,000. Once you reach that, aim for 3–6 months’ worth of essential living expenses.

How to stay consistent:

- Open a separate savings account

- Set up automatic transfers each payday

- Make it a “non-negotiable” part of your budget

Visual savings tools in a finance tracker template can help you stay motivated by showing steady progress.

Where to Keep Your Fund

One common question: Where should you keep your emergency fund? Ideally, use a high-yield savings account that’s separate from your checking. This way, your savings grow a little with interest—and you’re less tempted to dip into it.

Also, treat it as untouchable. A true emergency means things like job loss, urgent repairs, or medical needs—not concert tickets or holiday shopping.

Over time, as you build financial discipline, you can expand this into a tiered safety net:

- A mini fund for car maintenance

- A health savings buffer

- A bigger cushion for income loss

Each layer adds more peace of mind.

Looking for long-term mindset tips? Check out our finance affirmations guide.

Step 4: Tools for Using a Finance Cheat Sheet

Explore Digital and Paper Options

Different families prefer different tools, and that’s okay. The key is to choose one that fits your lifestyle.

Recommended tools:

- GoodNotes finance template free options for iPad users

- Budgeting apps like YNAB, Mint, or EveryDollar

- Printable spreadsheets and finance cheat sheets for hands-on planners

Don’t overcomplicate it. If a simple notebook works, stick with it. If you love digital dashboards, embrace them.

Step 5: Tackle Debt with a Strategic Plan

Snowball vs. Avalanche Methods

Debt can stall your financial progress, but choosing a repayment method helps you move forward. Two common approaches:

- Snowball method: Focus on paying off your smallest debt first to build momentum.

- Avalanche method: Tackle the highest interest rate first to save money long-term.

Stay Motivated

Whichever strategy you use, be consistent. Use your finance budget to identify areas where you can redirect money toward debt repayment—like cutting subscriptions or eating out less often.

Celebrate small wins like paying off a credit card—it fuels your momentum. You can even add a debt tracker to your monthly finance cheat sheet to watch your balances shrink.

Step 6: Automate Savings for Future Goals

Set and Label Savings Accounts

Don’t wait until you “have extra money” to save. Pay yourself first by automating transfers into designated accounts. Label each account clearly to align with your goals—like “Summer Road Trip” or “College Fund.”

Start small. Even $20 a week adds up over time. Many banks let you create sub-accounts to visually organize your goals.

Ideas for family savings:

- Vacations

- Holiday gifts

- Down payment fund

- Child education

Use your finance tracker template to assign target amounts and timelines to each goal.

Include Family Participation

Saving doesn’t have to be a solo mission. Get the whole family involved! For example, create a visual savings tracker on the fridge where kids can see progress toward a shared goal—like a beach vacation or new bikes. This keeps everyone engaged and helps children build smart habits early.

Some families like to use jars or envelopes for physical saving. Others prefer digital tools that use GoodNotes finance template free downloads to plan and visualize each savings goal with icons, colors, and progress bars.

Step 7: Monthly Review with a Finance Cheat Sheet

Schedule a Budget Check-In

Financial plans are living documents. Revisit your budget and goals every month. This keeps you aligned as a family and gives you a chance to adapt when life changes.

During your check-in:

- Compare actual spending vs. planned budget

- Update financial goals as needed

- Celebrate small wins—like a fully funded emergency fund!

Many finance cheat sheets come with built-in monthly reflection questions to help you stay mindful of financial habits and emotional spending triggers.

Pro Tip

Turn this into a family routine. Make it a short meeting over coffee or after the kids go to bed. Keep it positive and future-focused.

Final Thoughts: A Practical Plan for Everyday Families

Every step you take—no matter how small—is a win. Your financial plan doesn’t need to be perfect, it just needs to reflect your real life and adjust with your family’s needs.

Keep things simple:

- Use a single finance cheat sheet to centralize your goals and budget

- Make financial check-ins short, focused, and positive

- Reward progress, even if it’s just with a high-five or a special dinner

Money doesn’t have to be a source of stress. With the right tools and a little consistency, it becomes a tool for peace, stability, and even joy.

DISCLAIMER: This article is for informational purposes only and does not constitute financial advice. Always consult a certified financial planner for personalized guidance.