Finance Dashboard Excel: Practical Tips and Insights You Can Use

A finance dashboard in Excel can transform how families manage their income, expenses, and goals. A finance dashboard in Excel is one of the best ways to manage family finances without feeling overwhelmed. With the right tools — like a finance dashboard in Excel— staying on top of your income, expenses, and savings goals can become second nature. One of the most effective tools for this is a finance dashboard in Excel — a versatile, customizable solution that can help you take control of your financial future.

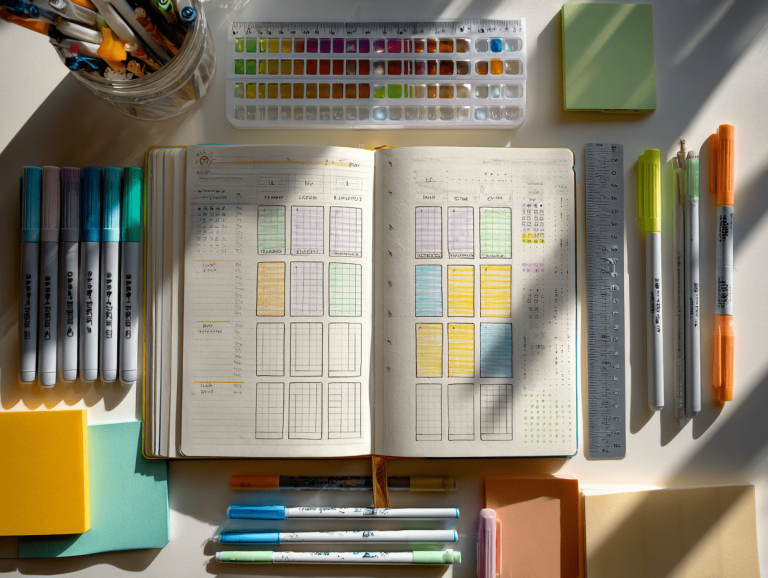

Whether you’re a seasoned spreadsheet pro or just starting to explore finance planner ideas, this article will guide you through how to build, customize, and use a personal finance dashboard that works for your family. We’ll also explore some great finance tracker alternatives, including Google Sheets, and share personal finance advice along the way.

Why You Should Use a Finance Dashboard in Excel for Family Budgeting?

A finance dashboard in Excel gives you a centralized view of your entire financial life. It’s like a digital command center where you can:

- Track income and expenses

- Monitor debt repayment

- Set monthly or yearly budgets

- Visualize cash flow and net worth

- Identify patterns and improve decision-making

Unlike pre-made budgeting apps, Excel offers the flexibility to tailor your dashboard to your exact needs. For families juggling multiple income streams, school expenses, mortgage payments, and savings goals, that level of customization is a game changer.

Getting Started: Building a Finance Dashboard in Excel Step by Step

Before diving into complex formulas and charts, start with the basics. Your Excel finance dashboard should include the following tabs or sections:

- Income Tracker – List all your income sources, including salaries, side gigs, tax refunds, and passive income.

- Expense Categories – Break down your spending by categories such as housing, groceries, transportation, childcare, and entertainment.

- Savings Goals – Set targets for emergency funds, vacations, or future investments.

- Debt Tracker – Monitor credit card balances, loan payments, and interest rates.

- Net Worth Calculator – Subtract your liabilities from your assets to see your financial health.

Each section feeds into the main dashboard page, which displays charts, graphs, and summaries to give you an at-a-glance view of your finances.

Personal Finance Advice: Make It a Weekly Habit

Even the best dashboard won’t help if you don’t use it consistently. One of the most valuable pieces of personal finance advice? Set a regular schedule to update your dashboard. Weekly check-ins can help you:

- Stay aligned with your budget

- Catch overspending early

- Keep your savings goals top of mind

Consider creating a recurring calendar event — maybe every Sunday evening — where you and your partner can review the dashboard together. This builds financial transparency and accountability, especially in a family setting.

Tips to Make Your Excel Dashboard Easy to Use

Excel is powerful, but it can also be intimidating. Here are some finance planner ideas to make your dashboard more user-friendly:

1. Use Data Validation

Create dropdown lists for expense categories to minimize data entry errors and keep things consistent.

2. Apply Conditional Formatting

Highlight budget overages in red or successful savings goals in green to make trends visible instantly.

3. Add Charts

Use simple bar graphs or pie charts to visualize monthly spending or savings breakdowns. This makes financial trends easier to understand, especially for visual learners.

4. Protect Your Sheets

These small adjustments help ensure your finance dashboard in Excel stays accurate and easy to maintain.

Want Something Online? Try a Finance Tracker in Google Sheets

If you prefer a cloud-based tool you can access from anywhere, a finance tracker in Google Sheets is an excellent alternative. It works similarly to Excel but offers easier sharing, automatic backups, and real-time collaboration — all ideal for busy families.

You can either build your own or use a free finance dashboard template from Google’s template gallery or online financial communities. Many templates already include budgeting categories, charts, and formulas to help you get started quickly.

Some benefits of using Google Sheets:

- Automatic syncing across devices

- Easy sharing between partners or household members

- Integration with Google Forms for simple expense entry

How to Customize a Finance Dashboard for Your Family’s Needs

Every family has unique financial priorities. That’s why one-size-fits-all templates can sometimes fall short. Customizing your finance dashboard in Excel helps align your financial tools with your family’s unique routines to your household’s specific goals and routines.

Here are a few examples of how you can customize your dashboard:

1. Add Schedules for Irregular Expenses

Many families face irregular but expected costs throughout the year — back-to-school shopping, holiday gifts, annual insurance premiums. These don’t fit neatly into a monthly budget, but they shouldn’t be surprises either.

Add a tab labeled “Annual Planner” or “Seasonal Expenses” where you project these costs and break them down into monthly savings goals.

2. Include a Section for Kids’ Expenses

From extracurricular activities and clothing to college savings, children come with their own financial footprints. You might create a dedicated section in your dashboard to monitor spending per child or category.

3. Split Transactions Between Categories

Real life isn’t always clean-cut. Sometimes a single receipt includes groceries, home goods, and pet supplies. In your Excel dashboard, create a transaction log with the ability to split a single entry into multiple categories.

Finance Planner Ideas: Improve Your Finance Dashboard in Excel

Looking to enhance your spreadsheet? Try these finance planner ideas:

- Spending Trends by Category: Use line charts to show how spending has changed over time.

- Emergency Fund Tracker: A visual progress bar that fills up as you contribute.

- Budget Variance Report: Compare planned vs. actual spending to improve accuracy.

- Subscription Audit: List all your recurring services and trim the ones you no longer use.

These features not only improve your dashboard but also encourage more mindful financial habits.

Sharing the Financial Load

Money management shouldn’t fall on one person’s shoulders. Whether you’re married, co-parenting, or in a multigenerational household, your Excel or Google Sheets dashboard can become a shared responsibility.

Save the file in a shared folder (like OneDrive or Dropbox), or use Google Sheets for real-time collaboration.

Some families even assign roles:

- One partner tracks income and investments

- Another monitors bills and debts

- Kids contribute to savings logs or “spending jars”

It becomes more than a spreadsheet — it’s a family finance hub.

Keeping It Simple vs. Going Pro

There’s a temptation to perfect your dashboard with automation and macros. But if you’re not comfortable with complex features, keep it simple. A basic, well-maintained system beats a complicated one that goes unused.

If you do want to level up, consider:

- Importing CSVs from your bank

- Using VBA for custom calculations

- Connecting APIs to sync real-time data (for advanced users)

Just remember to back up your data regularly and keep your files secure.

Common Pitfalls to Avoid

Even with the best intentions, families can fall into a few traps:

- Overcomplicating the setup: Stick with features you’ll actually use.

- Forgetting irregular expenses: Budget for annual fees, not just monthly bills.

- No backups: Always save a copy to the cloud or an external drive.

If you’re using Google Sheets, set a monthly version checkpoint to protect against accidental edits.

Final Thoughts: Small Changes, Big Impact with Your Finance Dashboard in Excel

Building and maintaining a finance dashboard in Excel isn’t just about numbers — it’s about creating financial clarity and building a future that reflects your values. Whether you use Excel or opt for a finance tracker in Google Sheets, consistency is key.

Start simple. Stay committed. Make it a habit.

Soon, you’ll spot spending leaks, build stronger savings, and feel more in control of your financial future. And when your family’s finances are in sync, everything else gets a little easier too.

So grab that spreadsheet — and take the first step toward financial peace of mind.

You’ve got this.

For more tools to manage your family budget, read our guide to simple monthly budgeting.